“Inelastic Demand Meets Optimal Supply of Risky Sovereign Bonds”, with Matias Moretti, Lorenzo Pandolfi, Sergio Schmukler, and German Villegas-Bauer.

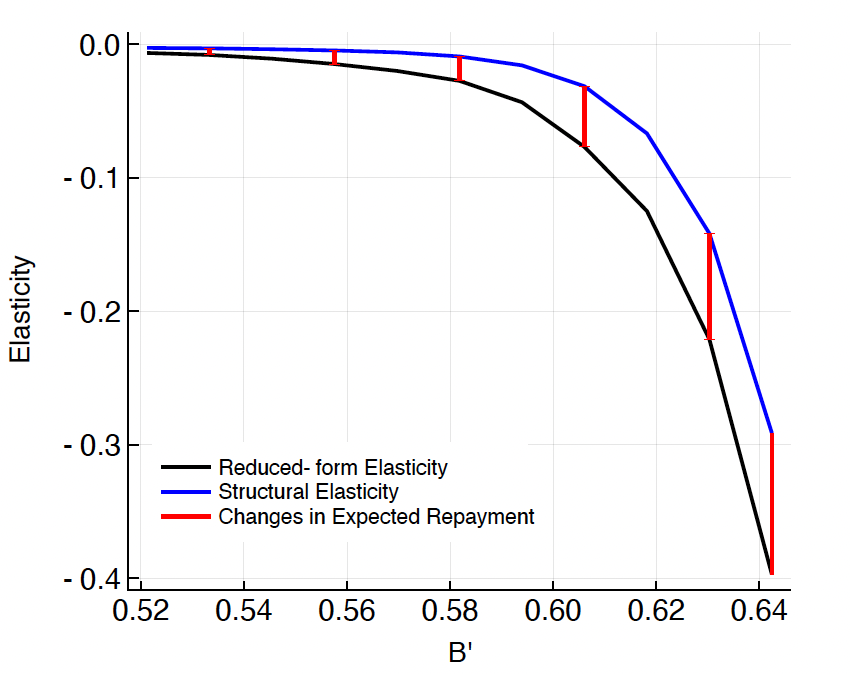

We present evidence of inelastic demand in the market for risky sovereign bonds and examine how it affects government policies. We exploit monthly changes in the composition of a major emerging market bond index to identify flow shocks that shift the available bond supply, which are unrelated to country fundamentals. Our estimates imply an average inverse price demand elasticity of -0.30, higher in magnitude than estimates for advanced economies. This elasticity increases with default risk, suggesting that investors demand a premium as compensation for risk. We develop a sovereign debt model with endogenous default, and we discipline it based on our empirical estimates. Under inelastic investors, an additional unit of debt lowers bond prices even under constant default risk. Because governments internalize this effect, the inelastic demand becomes a commitment device that limits debt issuances. Our quantitative model shows that this mechanism significantly reduces default risk and bond spreads.

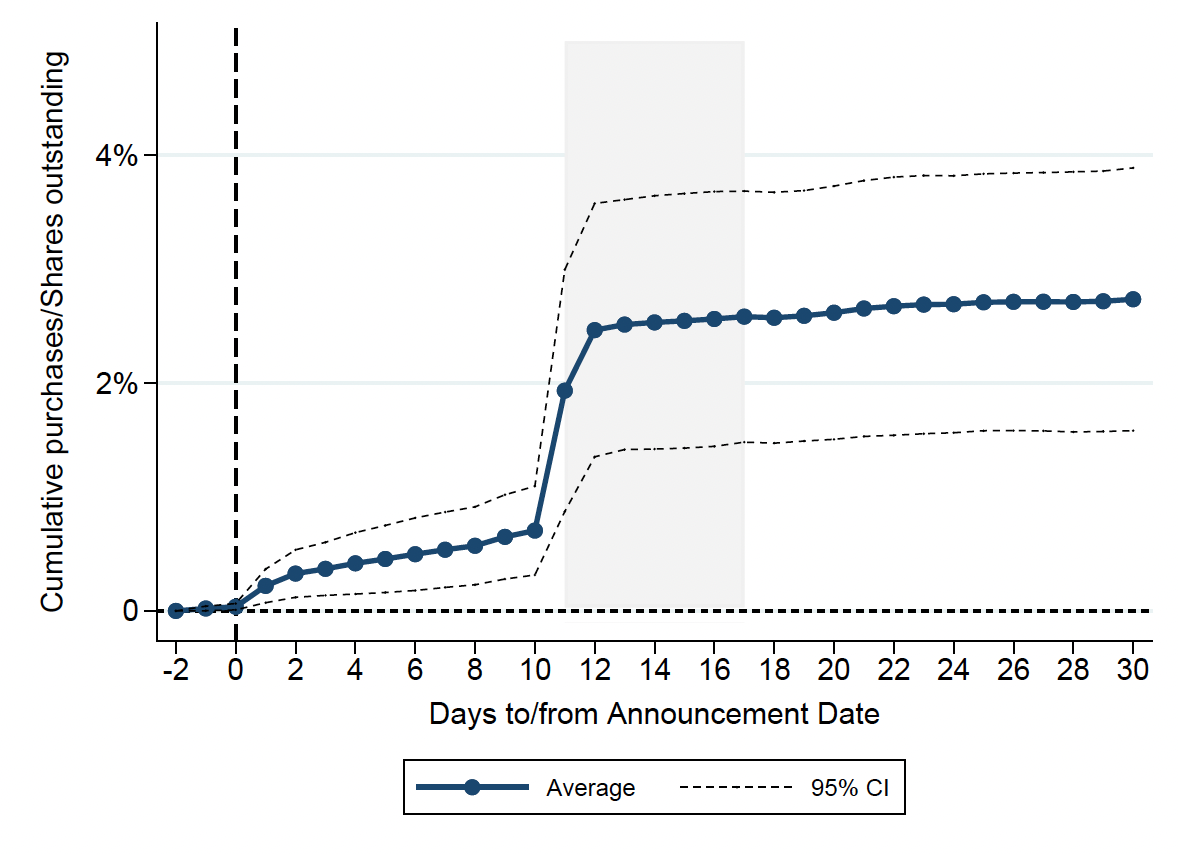

“The Anatomy of Index Rebalancings: Evidence from Transaction Data”, with Mariana Escobar, Lorenzo Pandolfi, and Alvaro Pedraza.

We exploit a novel dataset covering the universe of transactions in the Colombian Stock Exchange to analyze episodes of additions to and deletions from MSCI equity indexes. We find additions and deletions to have large price effects: the median cumulative abnormal return in absolute value is 5.5%. We show that these price effects are due to large demand shocks by different classes of international investors – not only passive funds and ETFs, but also active mutual funds, pension funds and government funds – which are not absorbed by arbitrageurs. Consistent with recent asset pricing models with limits to arbitrage, we estimate stock demand curves to be very inelastic: the demand elasticity for the median stock in our sample is -0.34, implying that a 1% increase in the demand for the stock increases its price by 2.9%.

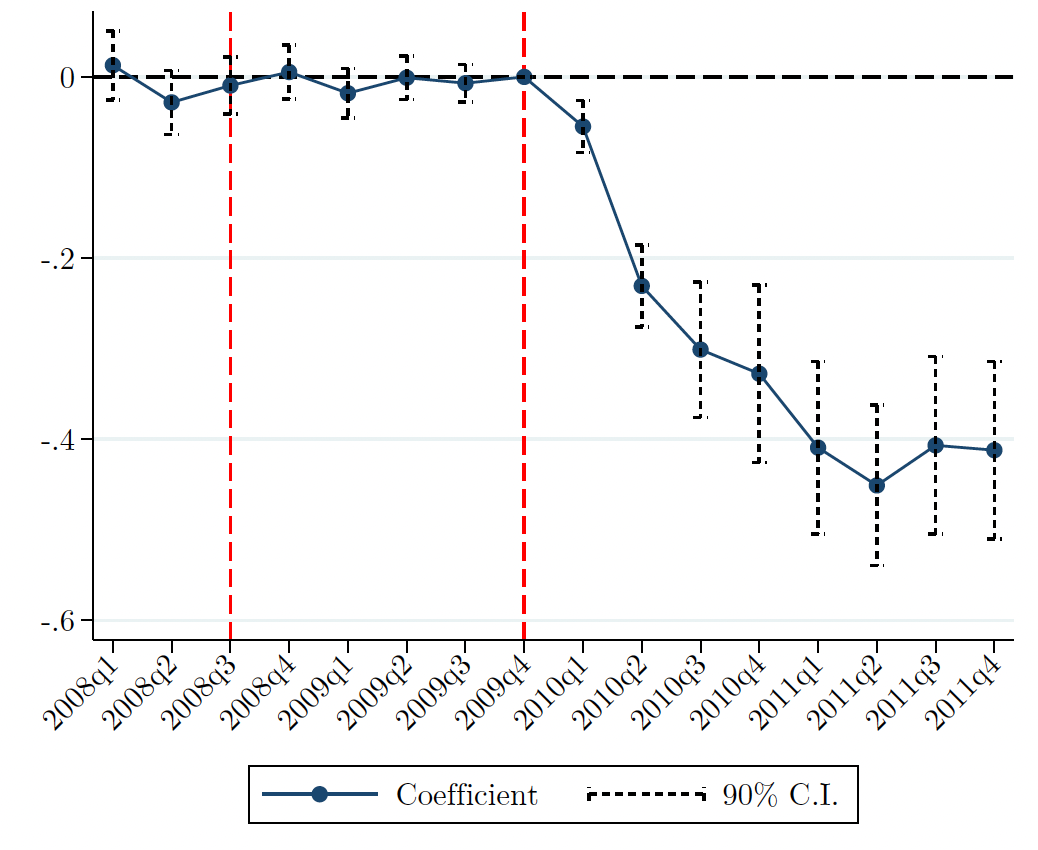

“Drug Money and Bank Lending: The Unintended Consequences of Anti-Money Laundering Policies”, with Pablo Slutzky and Mauricio Villamizar-Villegas.

We explore the unintended consequences of anti-money laundering (AML) policies. For identification, we exploit the implementation of the SARLAFT system in Colombia in 2008, aimed at controlling the flow of money from drug trafficking into the financial system. We find that bank deposits in municipalities with high drug trafficking activity decline after the implementation of the new AML policy. More importantly, this negative liquidity shock has consequences for credit in municipalities with little or nil drug trafficking. Banks that source their deposits from areas with high drug trafficking activity cut lending relative to banks that source their deposits from other areas. We show that this credit shortfall negatively impacted the real economy. Using a proprietary database containing data on bank-firm credit relationships, we show that small firms that rely on credit from affected banks experience a negative shock to investment, sales, size, and profitability. Additionally, we observe a reduction in employment in small firms. Our results suggest that the implementation of the AML policy had a negative effect on the real economy.